Doing something for your financial well-being is one of the most complicated things out there but at the same time one of the healthiest things you can do for your own peace of mind and peace of mind.

And is that money management is not easy at all. In fact, it is alarming that thousands of families are stunned by economic difficulties and not precisely because they do not have income or employment, but because they cannot find a balance in their finances.

And the main reason has to do with the fact that they never teach us at home to manage our money correctly or at least not with the correct principles, in contrast to the continuous commercial bombardment that makes us mistakenly think that “spend and pay later“is the formula to have everything you want.

Heal your personal finance sometimes it could take years and a lot of sacrifice. But if you really want to start TODAY, here I share at least 11 things and more that you can do for your financial well-being:

- Avoid compulsive shopping.

Stop buying to buy. Most things you don’t really need. Decide for yourself to stop this destructive habit of giving in to any object you see in a shop window. - Limit the amount of money to spend.

If control is your weakness, avoid carrying your debit or credit cards with you. If you are going out to eat, decide how much you want to bring and that will be the most you can spend. This will help you avoid excesses. - Create a personal spending budget.

If you really want positive advances in your pocket, create a personal budget of income and expenses. This will help you better visualize your current condition and make any necessary cuts. - Don’t spend more than you earn.

This premise seems obvious and even very hackneyed. Still, there is no clearer way to walk toward balanced finances. And it does not have to do with money precisely, it has to do with self-control. - Better plan your purchases.

Don’t buy impulsively. Don’t buy in the first place that comes your way. It is listed in several places. Compare. If you really have to buy something, look for the best option, the best price, the greatest benefits. - Use more cash, fewer cards.

This is a temporary technique that will help you be more aware of what you are spending. At least while you gain more control, make your purchases in cash so that you can better measure the extent of your consumption. - Write down your purchases.

Another effective technique to limit your expenses is to write them down in a small notebook. That way you can have more clarity of how much you are consuming. - Beware of ant expenses.

These are those very small expenses (in appearance) but that added together represent large sums of money that escape your budget. Such as small meals, unnecessary gifts, or unplanned outings. - Save a contingency reserve.

Emergencies always come up and can severely damage your budget if you don’t have at least one plan to meet them. It is best to have protection insurance such as medical or car expenses, but if not, try to save a small amount to have an emergency fund. - Pay your debts.

Nothing complicates things more than postponing or avoiding paying debts. Clearly define how much you owe. Make payment agreements to stop collecting interest. Make a payment plan and start releasing the pressure of debt. - Don’t pay debt with debt.

Consolidating your debts can be a good alternative if you do it planned. But pretending only to acquire one debt to pay another is financial suicide. If you feel desperate and need help, seek out an honest advisor to guide you. But for nothing in the world make decisions hastily.

Develop Your Financial Intelligence

The tips outlined above have to do with immediate action that can stop the heavy “debt rail”.

However, in order to have long-term improvements that really help you not only to have your finances in control, but to be able to grow and achieve financial freedom one day, here are some additional tips:

- Look for new sources to generate income. There are many things that you can do complementary to your current activities that will allow you to generate additional money. For example, these 14 ideas to generate income without leaving your job.

- Learn about financial intelligence. There are many ways to develop financial intelligence. Attending seminars, reading some good books or watching videos on the subject on the Internet. The important thing is that you are aware of the importance of this topic and that you start learning today. For example, I leave you these 15 tips from Robert Kiyosaki for young people about finances.

- Work as a freelancer. A freelancer is someone who does work from home and charges for it. There are many things that can be done as a freelancer that can earn you a good additional income. Here are some tips to become a professional freelancer.

- Learn how to put your money to work. One of the great secrets of financial intelligence is that your money works for you, instead of you working for money. If this topic is of interest to you, I suggest you read about how to earn money while you sleep.

Conclusions

- The most valuable resource you have is yourself. Discover your skills, know yourself, value yourself.

- The way you use your money is linked to your emotions and feelings. The better you control it, you will have a greater sense of tranquility.

- Your financial decisions affect your social relationships with those closest to you, for better or for worse. Base your financial decisions consciously on your personal and family needs and goals.

- If you lose your way at times, don’t run away or ignore your reality. Stop along the way, analyze your situation and make decisions that help you regain control.

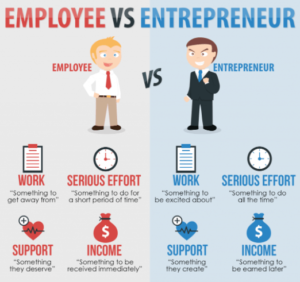

To be a true entrepreneur you need to dream, imagine and yearn but also work. You must project your future, set goals and define the steps to follow. You must train yourself, be creative and work tirelessly to achieve what you set out to do.

![How to Start Your Own Business [Guía] How to Start Your Own Business [Guía]](https://businessguarantor.com/wp-content/uploads/2021/03/how-to-start-your-own-business-guia-scaled.jpg)

![5 Ways To Get Initial Business Capital [actualizado] 5 Ways To Get Initial Business Capital [actualizado]](https://businessguarantor.com/wp-content/uploads/2021/03/5-ways-to-get-initial-business-capital-actualizado.jpg)