Decisions for improve your financial situation They can be taken at any time of year and although many people find it easier to start a new one, the reality is that the sooner the better.

Regardless of when you choose, the fundamentals remain the same. Here are eight keys to getting ahead financially:

1. Pay what you owe and spend less than you earn

It sounds simplistic, but many people struggle with this first basic rule of thumb. Make sure you know what your job is worth in the marketplace, by conducting an assessment of your skills, productivity, job tasks, contribution to the company, and current rate, both inside and outside the company. Being underpaid can have a significant cumulative effect throughout your work life.

No matter how much or how little you get paid, you will never get ahead if you spend more than you earn. It is often not easy to break the habit of overspending, but with a little effort to reduce expenses in various areas you can achieve big savings. It doesn’t always have to involve making big sacrifices.

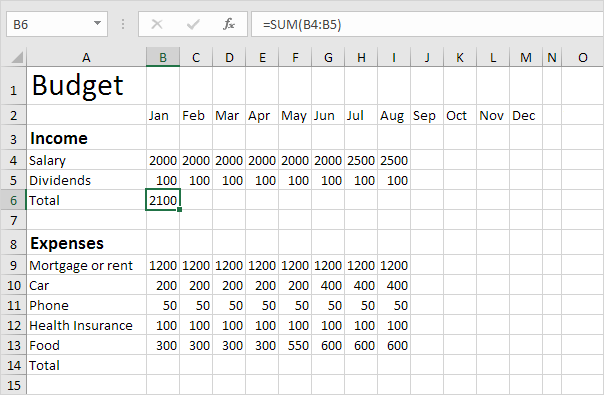

2. Stick to a budget

Budget. How can you know where your money is going if you don’t budget? How can you adjust spending and have savings goals if you don’t know where your money is going? You need an equal budget whether you make thousands or hundreds of thousands of dollars a year.

3. Pay off credit card debt

Credit card debt is the main obstacle to getting ahead financially. Those little plastic pieces are so easy to use, and it’s so easy to forget that this is the real money we’re dealing with when we pay for a purchase, large or small. Despite our good intentions to pay off the balance quickly, the reality is that it’s often not done, and you end up paying far more for things than you would have paid if it had been used in cash.

4. Have a Savings Plan

You’ve heard it before: Pay yourself first! If you wait until you have met all other financial obligations before seeing what is left for savings, you will most likely never have to open a savings or investment account. Aim to set aside a minimum of 5% (or a little more) of your salary for savings before you start paying your bills. Better yet, automatically withhold money from your paycheck and deposit it into a separate account.

5. Invest!

If you are contributing to a retirement plan or savings account and can still put some money in other investments, so much the better. It is not that it is easy but make an effort and invest in something that will leave you monthly profits, such as real estate or any other profitable micro-business.

6. Maximize the benefits of your job

Job benefits like flexible spending accounts, medical and dental insurance, etc., are worth a lot of money. Make sure that you are getting the most out of the money you can save by reducing taxes or other minor expenses.

7. Check your insurance coverage

It is important that you have sufficient health and life insurance to protect your dependents and your income in the event of death or disability. In the long run, insurance can save you a lot of money because when an emergency occurs there is no other way out than to get the money and in times of stress you will always spend more than you want.

8. Update your will

70% of the people in the world do not have a will and in Latin America the percentage is barely close to half. If you have dependents, no matter how little or how much you own, you need a will. Protect your loved ones. Write a will soon.

Plus financial advice: