So, let’s talk about Crowdfunding, what is it? and how it can help you get your business off the ground.

What is Crowdfunding?

To define the concept in simple words, we will say that crowdfunding is a financing system for business projects which is based on the collaboration of several funders who donate their resources forming collective networks to be able to bring the best business ideas to life.

The operating base of crowdfunding, as Wikipedia calls it in Spanish, also called crowdfunding or mass financing systems, consist of bringing together a group of financiers who add small amounts of capital to finance different business projects, social or even political.

Its greatest advantage is that you can obtain funds for your project without the high costs and interests that obtain a loan through traditional financial entities implies. And its main disadvantage is that you need a good business plan to sell your idea to donor networks to believe and support it.

The Internet and the impact of social networks have allowed the communities of collective donors not only to grow but also to be safer as they have more information regarding the projects they wish to support.

To give us an idea of its growth, only in 2012 the funds raised under the crowdfunding model exceeded 2.7 Billion dollars, increasing by 81%.

“People with money who trust people with ideas and work together to get a project forward” – Javier Martín

How does the Crowdfunding system work?

If you want to explore this alternative for finance your business idea you must understand the basics of how it works.

1. The Business Project. The first thing you have to have is an idea, a project and of course a business plan. You must be very clear about what you want to do and how you are going to do it. Your idea must be viable, useful, interesting and capable of conquering the minds and hearts of the people who like the good business ideas.

2. The Crowdfunding platform. Then you must search among the many that exist a platform on which to publish your project to request financing according to its category. At the end of the article we will provide some suggestions in this regard so that you can choose the one that is most convenient for your purposes.

3. The amount requested. At this point you must indicate how much money exactly you need to give life to your business and how exactly it will be used. The more information you present and with more detail, the better it will be because it transmits more confidence and responsibility on the part of you.

4. The term of evaluation of your project. Once your project is entered, you must wait a period ranging from 30 to 120 days for it to be evaluated by the community on the web and by donors who decide to invest in it. During this time you will have to do some promotion of your project to receive support, as the final decision of the granting of financial support will depend on it.

5. Approval. At the end of the evaluation period, the platform issues a resolution that approves or denies the financing. In some cases, approval actually depends on finding enough investors who believe in your idea and contribute the funds. In such a way that the approval is implicit in the fact of meeting or not the totality of the requested.

If approved, the funds are issued. And in case of not being approved, a reasonable period is granted so that you can make another attempt since most of the time it happens that the idea is very good but it is poorly raised or with insufficient documentation.

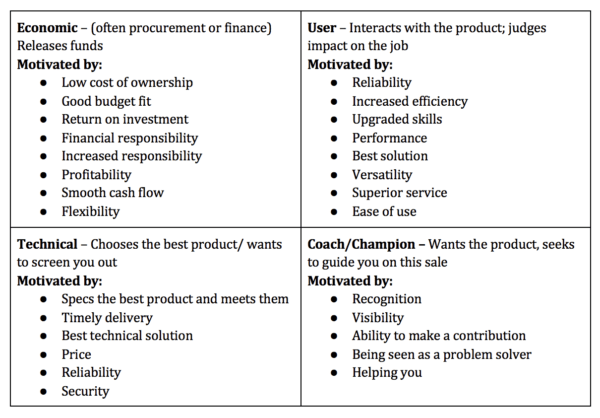

6. Origin of funds. As we described at the beginning, the funds for the financing come from microfinancers or people interested in supporting entrepreneurs and their projects and who are willing to donate small amounts to contribute.

7. Update your investors. It is very important and most platforms require that you constantly inform and update your donors about the progress and achievements of your project. Remember that this is a very important step because the primary purpose of a person who supports an enterprise does it for the pleasure of seeing it done.

Tips for planning a successful Crowdfunding project

- The information you publish is decisive. Prepare your business plan well And above all, make sure that your numbers are realistic and according to what you want to achieve.

- Do not try to get more money than you need or at least it seems that way because the opposite effect can result from the moment that investors perceive some data with distrust.

- Be concise and direct. Don’t expect people to read an 80-page document to believe in you. Be brief and efficient to convey the essence of your business idea.

- Use videos, presentations and any other additional resources you have to make your project easier to understand.

What Crowdfunding platforms exist to finance your project?

The good news is that this system has been so popular that every day there are more and better platforms to be eligible for financing. Some of the best known are:

Kickstarter

Probably the most successful site in mediation of crowdfunding funds is ., who to date have managed to finance more than 50,000 projects with more than 5 million donors.

Indiegogo

Platform founded in San Francisco that uses social networks and Paypal very heavily as a means of fundraising. They charge a 4% commission on funded projects.

..org

Excellent platform that manages financing for small entrepreneurs who reside in developing countries.

Drip

A Spanish non-profit website focused especially on raising financing for projects that generate benefits for society and that are especially social, cultural, educational or scientific.

Verkami

Multi-language platform focused on raising funds in a maximum period of 40 days especially for the support of artists, designers and creatives.

Of course there are many other successful platforms that you should evaluate before making your entrepreneurial project public.

Here you will find some more complete lists about the characteristics of these platforms for crowdfunding.

More resources for your business: