The security that this new alternative showed us and the ease with which payments were made made this company position itself as one of the strongest when it comes to electronic payments and is admitted in millions of establishments around the world.

Paypal not only allowed people to associate their credit cards to make secure payments without having to show our credit card, but it also serves as an electronic wallet in which we can deposit balance between accounts without having to affiliate with any bank.

This allowed many freelancers who provided services online to receive their payments through this means, it is more difficult to find a service that does not offer to receive or give shipments in Paypal.

The problem in some countries

In many Latin American countries, Paypal has restricted certain options such as withdrawing money from our accounts to our cards, which makes it impossible to physically have the balance of our accounts in Paypal.

Thus, many independent workers had to sell or spend their balance acquiring things so that it is not wasted, this great discomfort prevented many from accepting jobs under this payment method. On the other hand, in some countries Paypal was restricted, which also affected many people who could not hire jobs abroad due to this limitation in payment.

The business opportunity

The opportunity arises at the time we describe the above, because since there is no quick way to withdraw our money from Paypal, we offer the alternative of doing it in exchange for a commission.

We can start the business depending on one of the following assumptions:

- If our clients are from another country

- If our clients are from our country.

In both cases we must consider if we have facilities to carry out transactions from our PayPal accounts, if we can effectively withdraw the money or if it is necessary to find another alternative to have the balance.

For example, supposing that in Argentina you cannot withdraw money from Paypal accounts but in Spain you can, we can contact an Argentine client who sends us their money in Paypal to our account and we send the cash to him through Wester Union or Money Gram . On the other hand, find a client in Spain who requires a Paypal balance and who is willing to pay us in cash. So our investment will be almost zero and we will earn commissions from both sides.

If in case we have the facility to withdraw the money from Paypal directly to our credit cards, everything is easier since the process will not require contacting a client who can do the same, we just have to enable the option and see what more convenient for us.

Investment and earnings

Depending on the assumption in which we start we will need an investment that can be about $ 50 dollars. Before starting, we must study the Paypal Policies and the market situation in our country or the country in which we provide the service. We have to always be under the legal regimes to avoid any inconvenience in the future.

The profits will always be focused on the percentage of commission that we charge for the money exchange, generally it is applied to the amount received in percentages that go from 5% to 25%. We can increase our profits if we play with the current exchange rate, remember that every profit always adds up.

Final recommendations

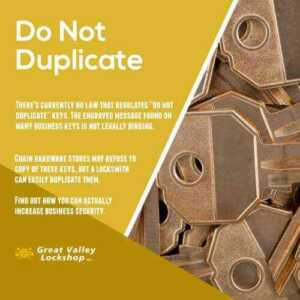

To start with Paypal it is necessary to have our real data, let’s not invent any data because if any inconvenience occurs and Paypal wants to verify the information we will have problems and our account will be frozen, we recommend reading the Company Policy well before starting.

We must focus our market and the search for clients, try not to be abusive in commissions and always keep in mind the opening hours in our bank and the facilities that are given to us for the change in cash. Managing times well will make our client feel safe and do not assume that business is bad.

Finally safety is important, try to negotiate with people who have verified accounts and whose data is real. Always send the money to the person who has the same data from the Paypal account, thus avoiding inconveniences in the future. Take all possible precautions and you will carry a safe business to success.

More online business ideas: