The event looks good and could mean some businessHowever, the only money you have for it would throw you off other important payments. What do you do?

The answer may seem obvious but it is not.

In reality, most of the time it becomes a dilemma between earning more or meeting established commitments.

Count on a monthly spending budget It is a great tool that will help you make these kinds of decisions correctly.

The topic of today: how to create a budget for your company.

What exactly is a budget?

Let’s define it in simple words. A budget is a control tool that allows you to manage your company’s expenses and that helps you to use your financial resources in an orderly manner.

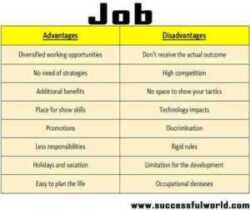

In fact, many of the financial problems small businesses may experience (and the big ones too) stem from 3 main budget-related causes:

- The absence of a budget. In other words, the tool does not exist or is not used.

- Misuse of it. The budget exists but is not respected or is handled at the discretion of managers.

- Poorly established financial priorities. A budget is drawn up but investment and expense priorities are poorly defined, with the consequent imbalance in business objectives.

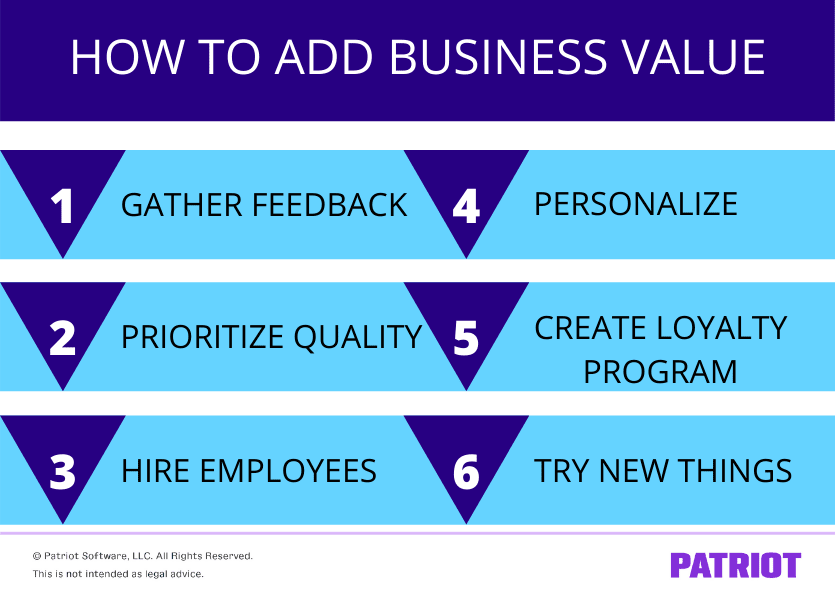

Advantages of a Budget

Having a monthly budget of expenses will allow you define clearly and objectively the priorities of your business and it will save you a lot of headaches since it will be the guide for the intelligent and orderly use of your money.

How to Prepare a Budget?

It is easier than you think, although you must dedicate enough time to it so that it really is a tool that fulfills its objective.

- The starting point is to put in pencil and paper (or an electronic sheet), a list of all the regular and projected expenses that your business has. Even better if the budget can be prepared annually, considering in advance all the events and different stages it goes through throughout the period.

- Once you have that list, then you order it by category, that is, you classify it so that it is easier to see how much money you will allocate to each thing. For example: rents, payroll, services, administrative expenses, payment of taxes, raw materials, promotion and advertising, sales, research, savings, emergencies, etc.

- Consider the possible cost variations derived from seasonal changes, currency changes, or scheduled increases for various reasons.

- Clearly define priorities. This is probably one of the main reasons for being on a budget. Since production is as important as sales. Human resources are as important as fixed costs. Hence, clearly defining what is important and how much money will be allocated to it is essential to maintain operating limits and ensure the success of your business.

- Set aside a fund for emergencies. Many businesses succumb when they do not have funds to absorb the impact of emergencies. Natural unforeseen events, crime, bad seasons, etc. These are just a few of the factors that could severely affect your business if you don’t have a fund to excel in tough times. If your budget contemplates it and your fund is in a savings account, those inevitable events will not end your company.

- Schedule a quarterly review of your budget. Periodically stopping to evaluate if the money is being used as we proposed and that your entire organization is clear about it, is decisive to avoid surprises. Once prepared, all board members of your company They should adhere to and respect established spending policies, and in fact, there must be someone in the company to look after them. If your business is small, that person is you.

- Ask for advice. If necessary, you can request the support of some Financial advisor or an accountant to help you review and optimize your budget to ensure that all expense items have been covered.

Finally, another very important objective of having a budget is to evaluate how your business is operating and determine if the use of financial resources is appropriate. Imagine that in the middle of the year you do an evaluation and the results show that you used 20% of your resources in superfluous expenses, something unnecessary or that could have been minimized. Then you can take actions so that in the next periods, this is corrected, with the consequent benefits of better invest your money and make the most of it.

We have a community of entrepreneurs on Facebook with more than 7000 followers. Follow us!

More themes for manage your business:

![How to Develop an Entrepreneurial Mindset [Podcast] How to Develop an Entrepreneurial Mindset [Podcast]](https://businessguarantor.com/wp-content/uploads/2021/03/how-to-develop-an-entrepreneurial-mindset-podcast.jpg)