This is the true story of Stephanie, a 26-year-old American girl who lived comfortably until she realized that she had fallen into the trap of free money to the point that she could no longer move forward without facing the problem of debt.

He tells us his story and how he did it step by step, hoping it will help many of our readers caught in that same trap.

“At 26, I was working really hard, thinking I had it all under control. I was still paying off my student loans and using my credit cards for my whims, like almost everyone else.

My parents didn’t have money to pay me for college, but that didn’t stop me from attending the University of Maryland to get my BA in Anthropology. Because I was having trouble getting scholarships and grants, I eventually had to do it with student loans that are often low-interest.

After I finished my degree, I got a $ 50,000 a year job and lived like anyone else. I’d hang out with my friends, shop for whims, and go on a trip while paying the minimum on my loans, in addition to the minimum on my credit cards. Everything was going well for me.

3 years ago I met a boy with whom I started to have a relationship. The time has come to make plans together, change cities to live with him, etc. This guy was a lover of finances and when the topic of my debt came up, he got to the bottom of it and discovered a problem that I never gave importance to.

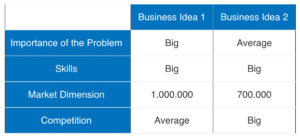

This guy added up all my debts in a spreadsheet and the result was like a slap in the face, since the total of my debts was 90,000 dollars, which made me an over-indebted person for the banks with many small loans.

If I continued to pay only the minimum of my debts, it would have taken more than 10 years to get rid of all these debts, without counting the interest.

My boyfriend showed me how every year I was more in debt instead of less, despite the fact that I was facing payments, a very common situation in people in debt, so he proposed a plan in which it would only take 3 years to remove those debts completely.

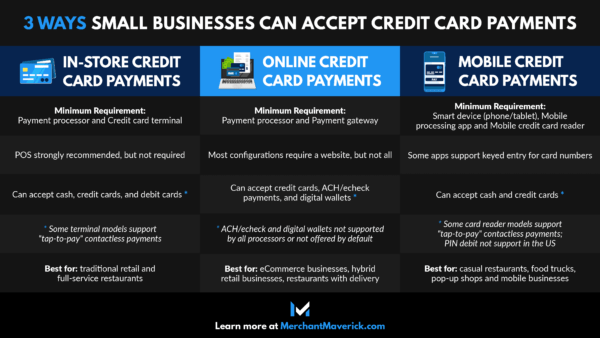

We sorted the debts from highest to lowest interest, so first I had credit cards, 15% interest, personal loans, 9% and finally the student loans that had been divided, between 2% and 3, 5%.

Those debts had to be made to disappear in that order.

Tricks to pay my debt

My student loans range from $ 3,000 to $ 20,000 for federal loans and some credit cards from $ 3,000 to $ 9,000, which being the highest interest rate, would be the first to remove.

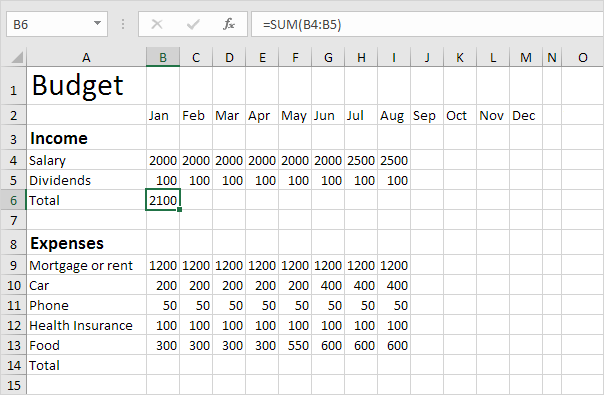

I began to make a budget of my monthly expenses, to try to find a way to save between 500 and 1,000 dollars a month and add them to the 800 dollars that I was paying for minimum credits.

- Rental: I left my flat where I lived alone and moved to a smaller flat, in a cheaper neighborhood, and looked for a roommate to cover expenses. With this measure, I cut the floor cost in half.

- Cable and subscriptions: I canceled my cable TV subscription and the subscriptions I received at my home. Thanks to the Internet, I could have both from my phone.

- Gym: I stopped paying the $ 95 a month for the gym and started exercising at home and outdoors.

- Telephone and insurance: I limited the use of calls and data until I cut my phone bill by $ 30, in addition to taking away some of the insurance I was paying for. I also reduced the car insurance by about $ 80 with another company.

- Entertainment: I changed my way of having fun. Party nights at home with friends and trying to enjoy the day much more on weekends, hiking or other healthier activities than going out until 6 in the morning between drinks. Not only did I save money, but I also met other types of people who gave me different things.

- Travels: I loved traveling, and I did not want to do without this at least once a year, but I did cut the vacation period and thanks to the Internet, I found different pages where Low Cost trips were offered for groups of people. Again, I saved on my vacation and met a lot of new people, very interesting people.

Having made the cuts in my expenses, now I had to find a way to earn extra money to be able to maximize my income and be able to get out of debt as quickly as possible.

- Baby sister: I signed up for a page specializing in babysitting services, where I work several hours a week taking care of children in my spare time and it pays well.

- Scientific studies: I signed up for all the scientific studies that I could, where they usually pay from 50 to 150 dollars to be part of the experiments (as long as they did not carry risk).

- Freelance: I signed up for various online freelance work sites, where some companies pay for a job done or for writing an article related to a specific topic. I was good at that and I could also do it in my spare time.

In my company they realized what I was doing and appreciated my will power to work so hard, so when there was some important task within my company to earn extra money, they used to offer it to me.

Some months I got more than 2,000 dollars of extra money (not all), but thanks to this effort in about 6 months I managed to get rid of my credit card debt, which allowed me to slow down the hard work rhythm and start taking the rest off of my loans.

My new life

I am currently debt free and already have some savings. Now many people ask me how I have done it, and the truth is that it is not easy, because some weeks I worked up to 20 overtime hours in addition to the 40 hours per week of my work.

My only reward was seeing how I was achieving my goal.

Was this effort worth it? Of course it was, otherwise you would still be paying those debts and they would probably continue to grow.

Original Article by A. Carlos Gonzalez Business in Time of Crisis