I for my part preferred sell cheaper but in higher volume. This may also be your dilemma in sales.

And it is not for less because everything entrepreneur at some point you have to define your profit margins. And although we all want to earn the best possible, there are some important rules to take into account when setting the prices that I share with you today:

- Your costs rule. The first thing you should take into account when setting the prices of your product are your costs. You must consider the costs of the entire operation of your business and not just the cost of your product. That is why it is essential to have a budget. Hence, it is extremely important to ensure that your costs are as favorable as possible to compete.

- People prefer cheap. Studies show that the consumer always prefers cheap. The same economic crises have moved people to seek ever greater price advantages. And that’s what has spawned many thrift shops and bazaars as attractive options.

- It can be sold high if you have added value. It is also proven that we are all willing to pay a little more for a product or service, if this represents some added value such as: faster deliveries, better cleaning, better service, home delivery and why not say it “with a smile “.

- Buy by volume. Another convenient strategy to be able to sell better is buying in volume. Of course, this requires having more capital but it can work very well if you apply it, for example, to the products with the highest turnover, not necessarily to all your inventory. That way, your suppliers will be willing to offer you a better price and therefore your profit margin will be better.

- Sell more expensive in products that require greater support or guarantees. Some products are sold and you don’t know more about the customer. This is the case for example of some candy, office supplies or clothing. You can sell cheaper on these products. However, when your product is more sophisticated and may require additional support or claims work at some point, then it is wise to handle higher prices. This is the case with bicycles, toys, cell phones or electrical appliances.

- Don’t pretend to get rich on your profit margin. You choose if you want to earn 15%, 25% or 40% on your product. If your costs are good you can get a better profit margin, however the mentality of getting the most out of a product line at the cost of “squeezing” the customer will not always be the most convenient.

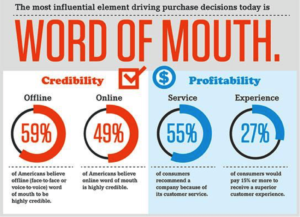

- Less margin can represent more customers. Remember that ultimately what keeps your business alive are the customers and if they perceive a high value or a great experience of buy in your business, then they will return and in addition they will refer you to other clients, thus representing greater profits. Hence, if your profit margin is 20%, but this customer returns another 5 times more, you would actually be earning the equivalent of 120%. And if he also recommends you with 3 other clients to consume a product, then we would be talking about a 180% profit. This is quite subjective but I only want to give you an idea of the scope it can have the proper management of prices in your business.

- Use your common sense. Do not be guided only by what the competition does or by your own prevailing need to want to earn more. Use your common sense, listen to your customers and do what is most convenient in the long term for your business.

conclusion

Sell cheap or sell expensive? It is very difficult to answer it in one word. Each product is different, as are the various commercial conditions in which we work. Like many others skills that entrepreneurs develop, this is like a game. A game in which we manage to buy better, sell better and earn better.

As always, my best wishes to you and your business! And how do you sell?

Others business tips and advice: