The rich know this and they get richer not because they work more, they get richer because they invest in assets that are appreciated.

So unless you are a professional in the stock market, you should invest in stocks, and if you are not an expert in jewelry either, better not risk being misled by fake pieces. Of this class of assets that are capitalized, real estate is usually the safest since capital appreciation is the most powerful characteristic to create wealth.

Passive Income

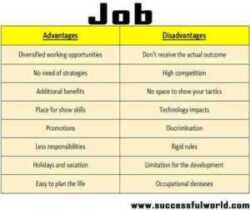

An active income is that income that occurs as a result of your sustained effort, such as a salary, fees or a commission. It has the characteristic that if you are not active, the income does not occur.

On the contrary, passive income is those that do not require your presence to be produced. And one of those passive income that exists is rental income since you do not have to be present or working to collect for the income. Except at the end of the month if you want to collect personally because you can even delegate this to an administrator.

So, you can live on your salary or your commissions but I assure you that you will enjoy better if you start investing in creating passive income.

How to Buy Houses with a Minimum Investment?

The concept that I am going to expose you is not new, on the contrary it is one of the oldest and most successful techniques used by large investors to create wealth and live on their income that still works very well.

Of course, as every business requires, you must learn, investigate and know the means to be able to make the investment intelligently. Second, although the title of the post says it clearly, you need to have a minimum capital for investment. And that minimum of course has to do with the level of properties and market in which you want to develop.

The business basically consists of investing in the financed purchase of a property (house or apartment) without having to pay the monthly payments. How is this possible?

Very simple, if you don’t pay your monthly installments, someone else will have to do it. And that person is the tenant. At the end of time, you will own real estate that you can resell for a very convenient market price.

As simple as it sounds, but many people do not use this mechanic for several reasons:

- natural fear of investing

- ignorance and lack of desire to learn

- because they shy away from the administrative issue of rent

- because they do not have the initial capital

These are the steps to follow:

- Find an attractive property with an adequate price and with credit options accessible to your socio-economic profile. Ideal that it is in an area where there is high demand for rentals.

- Carry out the purchase transaction by giving a down payment or down payment in such a way that the monthly fee to be paid is equivalent to the average rent that a tenant would pay for a house or apartment in that sector. The general rule for any bank financing is that if the down payment goes up, the fee goes down.

- Once the property is delivered to you, you proceed to put it up for rent and look for a responsible and good paying tenant. You sign a lease from there you have the guaranteed monthly payment. If you do not have knowledge on this point you can support yourself with a real estate consultant who usually handle all the tools to do the research and ensure a good prospect.

Example

So that you can better grasp the concept, look at this simple illustration (prices in dollars):

You buy a house priced at $ 100,000

You give as a down payment $ 15,000

The following year the house will have gained 5% in equity, so it is now worth $ 105,000

How much has your investment grown? The answer is $ 5,000

What would be the return on your investment (ROI)? : $ 5,000 / $ 100,000 = 5% right?

FALSE! Remember that you only invested $ 15,000 out of your pocket (the down payment)

Therefore, the true return on investment (ROI) is $ 5,000 / $ 15,000 = 33%

That’s right, a 33% return and you are also acquiring for only $ 15,000 a house valued at $ 100,000. Of course, you will have to deduct the administrative expenses of the operation and complete the term so that the property is yours or resell it when you have earned enough capital gains.

Price Vrs. Value

Usually the terms price and value are considered synonymous. However in real estate it is essential to make a difference. Price is the amount of money that the seller asks us for a good. Value would be the amount for which a good is represented in money in an established market.

The fact that a certain good has a price does not necessarily mean that it is worth it. It will only be worth it if we can resell it for the same amount or more. So our goal as buyers is to pay for what is really worth and that is where market research and the search for the best offer is key to the success of this business.

Heritable Business

Finally, another of the great advantages that I love about investing in properties and especially this method is the fact that real estate is a heritable business.

One of the concerns that most parents experience is that the effort of a lifetime is not diluted at the end of our days. Be it a bank account, a retirement pension or old-age insurance, all without exception are diminished and the result is a very depleted amount of inheritable money for the benefit of our heirs.

On the contrary, in real estate investments, the capital is preserved, grows and the monthly income continues in perpetuity for your children and their generations.