In this society, it often happens that a person who has done nothing especially wrong can still suffer the consequences. In some cases, these consequences include high debt, bad credit, and the personal stigma of having to decide whether to keep paying and paying for years, or just file for bankruptcy and live with it. There can be many problems on both sides, and shame is just as real as it is about dropping assets.

The good news is that you can ask for help no matter how bad your debt may have happened. In some cases, you may even turn around and be the help you need. While you are still alive, you still have a chance to turn over a completely new leaf. There are professionals at every step to help you.

Training with a friend

Not everyone can afford to hire a personal trainer, especially if your finances are limited. But what almost everyone can afford is finding a friend who also loves to play sports. Working out with the other person makes you more prone to this, and exercise in general can help reduce stress levels. Since you’re dating someone to work out with, you are more likely to show up because you don’t want to let them down. Then chatting can help you work through the parts of your life that are going better. Not everything has to be about debt.

Conversation

In many cases it is possible to negotiate debts without the need for bankruptcy. For example, in the case of medical arrears, most healthcare professionals actually take into account the fact that some people simply cannot pay what they officially owe. In such cases, you can use a significant portion of your debt without any additional damage to your credit.

Naturally, the best time to negotiate is as early as possible. Getting ahead of debt is the best way. However, if this hasn’t happened for whatever reason, it may not be too late to find out if you can ask for debt relief. Of course, documentation is required, but in many cases it works. In the case of credit cards, mortgages, and other types of debt that can skyrocket, negotiation is sometimes a viable way to get out of the hole.

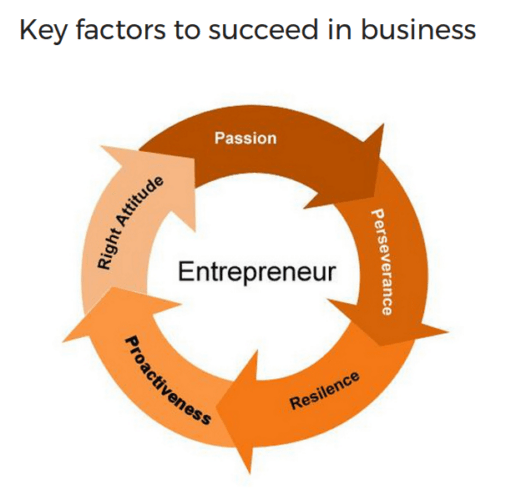

To be the help you need

Sometimes it can help become the kind of help you could use. Some people get out of deep financial holes by starting businesses, including starting a loan and repair company. Something you do is open a credit repair merchant account that will allow you to help people whose credit isn’t perfect either. You will understand very well what they are going through and will be able to give advice based only on experience.