The number of people who will retire poor continues to rise. There are many explanations for this, including the increase in the cost of living and the decrease in minimum wages.

The workers hardly manage to get their necks out of the water, and in the end many people are forced to retire poor. The situation is common, although this is more prominent in some countries than others.

“Money is not essential in life, but it is at the height of oxygen”, according to Zig Ziglar

Money may lag behind health, great relationships, and career fulfillment in terms of importance, but as Ziglar says, “lives up to oxygen“.

However, the sad reality of life is that less than 5% of people will be financially free by age 65. In other words, more than 95% of people will retire poor.

What makes people retire poor?

In his excellent 1956 recording of The Strangest Secret, Earl Nightingale tracked the fortunes of about 100 people who started out bright-eyed and busy at age 25.

These people were all well motivated and eager to succeed. “By the time they are 65, only one will be rich, four will have financial independence, five will continue to work, and 90 will be bankrupt depending on the others for basic needs.”

These statistics are alarming and should justifiably prompt us to rethink the question “why are 95% of people broke at age 65?”

In other words, Why do 95% of people retire poor?

Here are ten reasons that offer some answers.

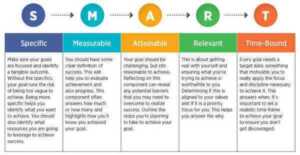

1. They never clearly define financial freedom

Freedom can have a different meaning for different people. Therefore, achieving financial freedom can have a variable definition for each individual.

The simple and straightforward definition of financial freedom is: passive income must be greater than or equal to lifestyle expenses.

IP ≥ EV

To achieve financial freedom and avoid being poor at retirement, your passive income from your assets must be greater than or equal to the income you need to finance your chosen lifestyle.

Most people retire poor simply because they don’t have a clear definition of financial freedom for their lives.

2. They never make freedom an absolute duty

Many people are too lazy to be productive. If you ask a hundred people how they plan to get rich, most will tell you that they would love to win the lottery or marry Heir (Heiress), or inherit a fortune.

That mindset means that most people retire poor because they don’t have a plan.

Sadly, hope is not a strategy, and to achieve financial freedom and retire rich, you must be relentless and ruthless in pursuit of your goals.

“hope is not a strategy”

3. They are unaware of the power of their subconscious mind

Have you ever come across the phrase, “the rich think like the rich and the poor think like the poor?“

Trust me, we all have a self-concept. You have a self-concept for your weight, for your business intelligence, and for your communication skills. Equally and critically, you have a self-concept for your current financial reality.

It’s quite fascinating, but many people who won the lottery lost it in no time. On the contrary, many people who file for bankruptcy regain their lost fortune quickly. Your subconscious mind will set your financial thermostat. Similar to a thermostat that controls the temperature in a room, your financial thermostat dictates your financial reality.

If you are serious about being financially free in retirement, you must first examine what financial files are stored in your subconscious mind. If you have the wrong data, you will continually have an adverse financial reality. That can easily lead to a poor retirement. Get a mental check-up to see where you are.

Harv Eker sums it up properly when he says “the only way to change the temperature in the room is to reset the thermostat“.

4. They are surrounded and influenced by other poor people

Many people do not realize the influence that their reference group has on their destiny. Ziglar once said, “you can’t fly with eagles if you scratch yourself with turkeys“.

If you are serious about achieving financial freedom, it is essential that you surround yourself with smart advisors. At the very least, you need a dynamic accountant, equally, a banker who understands you and understands your business.

You also need access to people who are financially free.

Learn from them, model them. Imitate them, success always leaves clues. You learn from people who retire rich and also watch those who don’t – you learn from people who retire poor.

There is a common saying that “birds of the same plumage fly together. ” Today you can start proactively and choose to surround yourself with financially free people.

See also: 15 Tips for Young People by Robert Kiyosaki

5. They never face the brutal facts of their financial reality.

If you ask people about their financial situation, most will tell you that they don’t want to talk or think about it. Many will tell you that they will have a financial advisor or financial planner to handle their finances.

Brown envelopes and bank statements are the two most frequently unopened documents in the world. The reason for this is that there is an inherent aversion within us to face the brutal facts of our finances.

To further your quest for financial freedom, it is imperative that you manage your finances yourself and face the brutal truth about them. One of the surest ways to retire poor is to evade that truth about your finances.

6. They don’t save

Many people will retire poor simply because they don’t have a golden goose or because he is frequently murdered in the name of immediate gratification.

Do you remember the fable of the golden goose? Long, long ago, a family took possession of a goose that laid golden eggs. After a while, the family got greedy and killed the golden goose to extract all the golden eggs in its innards. Sadly, by killing the Golden Goose, they also killed its income producing mechanism.

If ever there is a habit that everyone should adopt, it should be the habit of saving. Unfortunately, millions of people find one excuse or another for not saving. Without savings, your financial dreams could be in far off ground.

Pay yourself first!

In his classic book, ‘The Richest Man in Babylon’, George S. Classons advises that we pay ourselves first. Although there will be hundreds of excuses for not doing it. That could be the biggest step you will take to achieve financial freedom.

How often are workers seen buying new cars or moving to an expensive neighborhood when they receive a raise. People who could not delay gratification will likely retire poor.

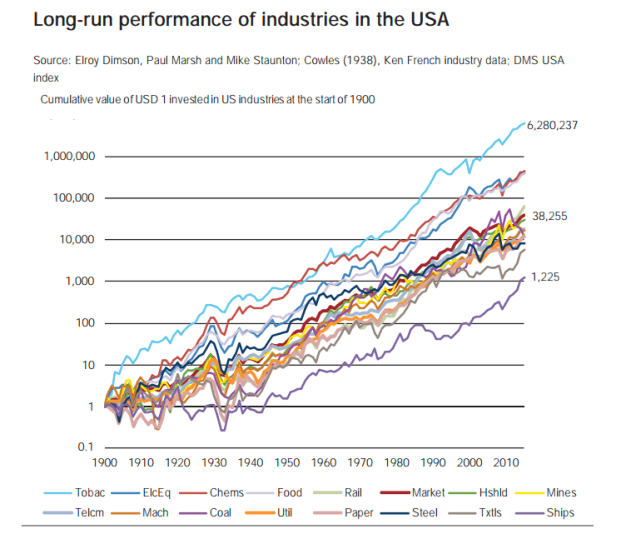

7. They are unaware of the power of compound growth

“Compound growth is the eighth wonder of the world” – Albert Einstein.

Compound interest can make or break you financially. In fact, it can make your life happy or miserable.

Why? Compound interest can greatly increase your wealth and also increase your debt incredibly.

8. They work for money as opposed to having money working for them.

In general, income manifests itself in three ways;

- Income from work– This is the income that is generally earned as a paycheck or salary for the product or service provided.

- Portfolio income: represents the income derived from shares, income, investments and pensions.

- Passive income– This is income that is earned without having to work full time to earn it. An example would be income from rentals, royalties, patents, online products or services.

In his excellent book, “Retire Young Retire Rich,” Robert Kiyosaki suggests that earned income is the worst source of income for several reasons.

First, it is the highest taxable income. Second, you have to work hard to achieve it, and it absorbs all your precious free time. Third, there is limited leverage, as the only way to earn more is to work harder and harder. Finally, there is a minimal precious residual value in this income, as each day you have to start over.

A significant difference in the mindset between rich and poor is that rich people have money working for them instead of working for money. This is the true path to financial freedom.

If you want to retire poor, keep working for money without an alternative source of income.

9. They lack the knowledge, skills and training to be financially free

Knowledge is said to be power. If that is true, only a few are ready to pay the price to acquire that knowledge. The poor are the group of people with the worst reading habit. They find it difficult to invest in financial education.

Without a solid financial education, achieving financial freedom will be a very rigorous task. As the saying goes: “Life is tough, but you can make it harder if you’re stupid“Achieving financial freedom takes a lot of work. But you can make it more difficult if you are financially ignorant.

“Life is tough, but you can make it harder if you’re stupid“

It is vital to acquire and sharpen your financial skills to be financially free. Fortunately, with the advent of the Internet, acquiring knowledge has become infinitely more accessible. There are no excuses now.

To generate a stable, secure and consistent income from investments, you will need to acquire good financial knowledge and improve your skills with good practices over time.

The acquisition of knowledge can be through books, financial games or seminars and business trainers.

As employees it is simpler to acquire practical knowledge and skills than to acquire financial knowledge. This is what keeps most people in the rat race and retiring poor.

10. They don’t have any plans, or they lack the willpower to move forward.

There are many differences in the strategies used by all the great investors. However, they all have two things in common; Everyone had a plan and they follow it. It is imperative to have a plan on how you are going to achieve financial freedom.

Your search will be doomed without a plan. Planning is essential. Even a bad plan is much better than no plan. (At least you know it’s terrible, and you can work on it to improve it.)

Most people never plan for their retirement, and the largest percentage of those who do do so too late. To avoid retiring poor, you need an early plan in your company; one that will take you to your financial destination.

You can study the strategies of the big investors and choose the one that appeals to them the most. It is imperative that you stick with that. Consistency of purpose and practice is what ultimately wins in generating continuous profit.

Make up your mind and choose!

In their excellent book, ‘The Millionaire Next Door’: Tom Stanley and William Danko highlight how two families, living in the same type of house and employed in the same job, end up with totally different financial scenarios. At age 40, one is financially free. The other is mired in debt and despair.

The reason is not education, opportunity, or luck. It’s simple; It’s a matter of choice. Retiring rich or retiring poor is an option, and no one can make that decision for you.

Today you have another opportunity to choose the path you want to follow. The way to get rich and prosperous or the way to remain poor. So choose wisely.

Original source: Money with a purpose