However, when things get complicated and you suddenly find yourself caught in a storm of debt from which it seems impossible to get out, that is when you need to take drastic actions and decisions with urgent sense.

Today I share 10 tips that you can start practicing today to get out of debt and restore your business.

In the first part of this article we discussed that debt is not the end of your business and I presented two important examples of how famous entrepreneurs have acted in times of crisis in their businesses. They are Donald Trump and Robert Kiyosaki.

An old saying goes that half of the solution to the problem is just to recognize the problem. And on the subject of get out of debt, this is essential.

What is it that has led you and your business to the situation you are in?

The reasons why many businesses become financially distressed to the point of being at risk of bankruptcy can be varied:

- Changes in market conditions

- Global crisis situations that directly affect your business

- Variable political decisions such as: fiscal conditions or import and export policies

- Delinquency

- Loss of important clients

- Mismanagement of financial resources

- Negligence

However, it is regrettable to recognize that the main reasons why companies experience serious debt problems are usually the last two: Negligence and mismanagement by their managers and administrators.

Whatever the reasons, you should be clear that getting out of debt can take time, and the more time you allow to start working the worse the effects can be. So I recommend that after you finish reading this article, take a pencil and paper and start making some decisions.

Important decisions to get out of debt

- You must identify what are really the causes that are affecting your business. Identify them and determine the extent to which you have a chance to counteract their effects. If the causes are external, then find out enough to determine the actions to take and if the causes are internal, you will have to make decisions in order to nip the source of the problem.

- Analyze your monthly budget immediately and conscientiously. Identify the monthly fixed expenses that are totally essential and reduce the others. Identify variable expenses and make sure to cut any unnecessary expenses immediately. This will immediately leave you room to undo some payments with creditors.

- Take an X-ray of your debts (liabilities). This is a complete summary of all the debts you currently have. Make sure to include all that you owe. Don’t fool yourself by pretending to hide “small debts”. The clearer you are, the better decisions you can make.

Include in this radiograph: Debts to suppliers, credit cards, loans that you have made to relatives or third parties, payments that you make monthly for the acquisition of goods, etc. And once you have it, add it up and get a total. This will be your real passive state and it is better to have it very clear from this moment, to project a realistic plan of how to get out of debt.

- Negotiate with your creditors. One of the most important steps for the good of get out of your debts is negotiation. The pressure from creditors is usually very strong especially when they do not receive a penny from you. However, you will be surprised how willing many of them (especially the larger ones) will be to recondition your debt if you openly approach to negotiate and request help with payments. Of course, as long as you commit and comply. An additional alternative is to propose partial payments with products or services, which represents a good alternative in exchange for not recovering their capital.

- Do not try to pay off one debt with another. Another common mistake that is made when we are under so much pressure is pretending to pay debts by making loans or using credit cards. This is an all too frequent temptation that we must avoid at all costs. If your credit card is creating problems for you, it may be time to cut it into little pieces and place it where it won’t cause more problems. Of course, this requires a lot of courage and a real desire to get out.

- Cut your ant expenses immediately. This point is directly related to No. 2, but I mention it separately in order to highlight the importance of firmly cutting back all those small expenses that are barely noticed but that collectively consume a very large amount of valuable cash for payments.

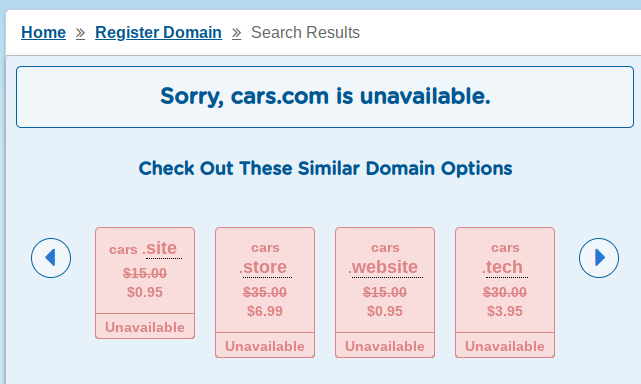

Unnecessary meals, gasoline for trips that can be skipped, telephone expenses, Internet, extraordinary service payments, inappropriate use of valuable resources in the company, paper and even inks, to name just a few, are ant expenses that may be eating your business and that you can clip today.

- Evaluate and adjust your payroll. Unfortunately in difficult times, it is convenient and urgent to review the payroll. Of course, dispensing with valuable personnel is not what we all want, but it is one of the obligatory measures when the survival of the company calls for it. Analyze the positions and seek a smart redistribution of work so that you can continue to do the same with less staff.

Be sure to explain clearly the reasons that move you to make such a drastic decision and with gratitude and a good letter of recommendation reduces your staff to the minimum necessary. And the labor liability? In most cases, you can also negotiate a payment plan in order to fulfill this responsibility without having to have it in a single payment (although you must be prepared because there will be exceptions).

- Don’t promise something that you can’t deliver. The problem when we desperately want to get out of debt is that we commit (wrongly) with our creditors to comply on a certain date or with certain amounts, knowing many times that we will not be able to pay under those conditions. That is a bad habit that you must stop to avoid further losing credibility.

- Sell more, spend less. Optimizing resources should be a constant habit. But to get out of debt, it is a mandatory habit. If you don’t have enough salespeople, leave your desk and go out to get more sales, more customers, more business. Remember that comfort is the enemy of successful business.

- If necessary, change course. Finally, you must still be prepared to change the course of your company. If the current conditions of your business have changed, if your market has changed, if the possibilities of continuing to operate healthily are remote, then you must be willing to consider a change of direction.

Whether you are considering another product line, another kind of business, or a new company, this is totally valid and acceptable. Just make sure you keep your commitments and then take time to fill in and take the step of making the changes that you consider convenient in your business.

Although these tips are quite practical and I am sure they will help you rescue your business, you must be very clear that it will not be easy. In fact, it takes a lot of strength to get ahead and bear the injury, often the shame and even the weight of the condemnation of those close to you, but ultimately it is a price that must be paid to get rid, get out of debt and restore your business ..

Regarding failure, don’t worry. Failure is only part of the curriculum in the career of success.

You already know that your comments are welcome and surely your experience will help others.

Other related topics: